Taurus Gold Token is based on the indicated resource classification. This classification offers a moderate level of confidence and presents a relatively low-risk opportunity with the potential for increased valuation through further exploration and resource upgrades. The indicated resource is valued at 40% of the intrinsic value, which represents an estimate of the core economic worth of the gold resource before extraction. With additional drilling that upgrades the mineral classification from indicated to measured, increasing the token value to 80% of the intrinsic value.

These valuation figures are also sensitive to fluctuations in the current gold price; as gold prices rise, potential returns for investors increase proportionally. The intrinsic value of Taurus Gold is a key metric that captures the inherent profitability and stable economic worth of the certified Taurus Gold Resources prior to actual extraction. It serves as a fundamental benchmark for investors to assess the true economic potential of the tokenized in-ground gold. Overall, this process underscores the importance of detailed drilling and classification to optimize the valuation and attractiveness of the gold resource to investors.

This intrinsic value is calculated as follows:

Taurus Gold Baseline Intrinsic Value = COMEX Spot Gold Price — AISC (The All-In Sustaining Cost)

AISC is calculated at $1250

Example of Intrinsic Price:

If the Gold Spot price is $3,300 and the current cost of production (or intrinsic value) is $1,250, then the intrinsic price would be calculated as:

$3,300 (Spot Price) - $1,250 (Intrinsic Cost) = $2,050 per ounce

We Present - You Decide

Taurus Gold token provides you with the opportunity to evaluate the asset and decide if its offerings align with your interests, allowing you to weigh the risks. Unlike similar companies that invest on your behalf without revealing the specifics, Taurus Gold invites you to view the asset directly.

The core of the Taurus Gold Digital model is based on Certified Taurus Gold Resources. Not all in-ground gold deposits qualify for tokenization; only those that meet strict criteria ensuring accuracy, reliability, and transparency are eligible.

Taurus Gold focuses on indicated resource class, which provides potential upside to market valuation. The resource classification table is explained below. These resources are verified using globally recognized standards—specifically NI 43-101—trusted by stock exchanges, mining investors, and industry leaders worldwide. NI 43-101 is considered the highest independent reporting standard for validating in-ground gold deposits. Resources are upgraded through ongoing drilling programs to enhance their classification and thus value.

1. Seed and development

That’s the stage where dreams and ideas are innovated and where the assessment of making it into a reality happens.

Business Risk : Extremely High Risk

2. Startup

It’s the phase where structure takes place and funding are precured through either loans, savings, or investors. Most often business owners will “bootstrap” and work within their own means. It’s also the stage where learning, trying and “walking the street” takes place. It's by far the hardest stage! often nine ot of ten businesses will sadly fail.

Business risk : High

3. Growth and survival (Entry Point)The growth phase is where the business solidifies its place in the market and its view on the future. Its also the that most business owners will require an outside investment to grow, expand and mature the business.

Business Risk : Medium with the higest ROI

4. Expansion

The business is stable, routine and has an established a record of accomplishment creating confidence. This is where rapid growth takes place in equity, revenues, and cash flow. It's now considered a low-risk investment depending on the number of years it's been in operation. It’s also time to consider a possible exit.

Business Risk : Low

5. Maturity and possible exit

a mature business chugs along with sustainable profit growth and loyal employees reaching long service leave time. Many mature businesses have a strong cash position, which makes them an attractive target for listings, mergers or acquisitions. The business may also reach a position where it devolves into spin-offs for other products or services and grows into a wider subsidiary group

Business Risk : Very low

Inferred

These are the least certain, based on limited data. They are speculative and require further exploration to confirm their feasibility for mining

Indicated

(Entry)

These are less certain than measured but still based on sufficient drilling results and data. They have a reasonable level of geological confidence, but certain assumptions or extrapolations are involved

Measued

(Exit)

These are the most certain resources, with detailed and reliable geological and grade data obtained through sampling, drilling, and testing. The estimate includes precise location, grade, and quantity.

Glossary

Gold Spot -$1250 = Intrinsic Value

Inferred : 20% of intrinsic ( N/A)

Indicated: 40% of intrinsic (Entry)

Measured : 80% of intrinsic (Exit)

Each Taurus coin represents 1 ounce of gold-equivalent exposure, priced at a significant discount to its verified intrinsic value

Enhancing the valuation of a major gold mine requires precise estimation of its recoverable gold reserves. This process is based on solid data rather than assumptions, relying heavily on extensive drilling campaigns, geological information, and compliance with regulations like NI 43-101. Resources are categorized into Inferred, Indicated, and Measured classes, with the scope of drilling—both vertically and horizontally—determining how much gold can be reliably estimated and the confidence level associated with the deposit. Generally, the higher the resource classification’s certainty, the greater the market valuation

Taurus Gold Token is based on the indicated resource classification. This classification offers a moderate level of confidence and presents a relatively low-risk opportunity with the potential for increased valuation through further exploration and resource upgrades. The indicated resource is valued at 40% of the intrinsic value, which represents an estimate of the core economic worth of the gold resource before extraction. With additional drilling that upgrades the mineral classification from indicated to measured, increasing the token value to 80% of the intrinsic value

These valuation figures are also sensitive to fluctuations in the current gold price; as gold prices rise, potential returns for investors increase proportionally. The intrinsic value of Taurus Gold is a key metric that captures the inherent profitability and stable economic worth of the certified Taurus Gold Resources prior to actual extraction. It serves as a fundamental benchmark for investors to assess the true economic potential of the tokenized in-ground gold. Overall, this process highlights the importance of detailed drilling and classification to optimize the valuation and attractiveness of the gold resource to investors.

This intrinsic value is calculated with the following formula:

Taurus Gold Baseline Intrinsic Value = COMEX Spot Gold Price — AISC (The All-In Sustaining Cost)

AISC is calculated at $1250

Example of Intrinsic Price:

If the Gold Spot price is $3,300 and the current cost of production (or intrinsic value) is $1,250, then the intrinsic price would be calculated as:

$3,300 (Spot Price) - $1,250 (Intrinsic Cost) = $2,050 per ounce

Tokenizing Gold Offering:

Key Investment Metrics

Indicated Classification Value at Launch | Description |

|---|---|

Gold Ounces available for tokenization | 50,000 |

Total Token Release | 50,000 |

Current Gold Spot | $3350 Per Ounce |

Intrinsic Value | $2100 Per Ounce |

Taurus Gold Token (40%) | $840 |

Projected Measured Classification | Description |

|---|---|

Projected Gold Spot (low) | $4500 per Ounce |

Projected Gold Spot (High) | $5500 per Ounce |

Projected Intrinsic Price (low) | $3250 per Ounce |

Projected Intrinsic Price (low) | $4250 per Ounce |

Taurus Gold Token price (80%) - High | $3400 per Token |

Taurus Gold Token price (80%) - low | $2600 per Token |

Projected ROI (pre-tax) | 209% - 304% |

Duration | 24-36 Months |

**Projected prices have been derived from JP Morgan Chase and other financial institutions in predicting the low and high. It is purely speculative.

Brief Investment Overview

Taurus Gold Token provides exclusive early-stage exposure to verified gold reserves at a compelling discount—backed by tangible ounces, not speculation. This isn't just a token; it's a stake in real, proven assets.

Taurus guarantees a fixed supply with a carefully managed, limited offering per zone—ensuring no dilution and no surprises. The asset is in advanced development stages, providing a short-term investment opportunity with substantial upside potential.

This innovative token offers leveraged exposure to the growing gold market and unlocks additional value as select zones progress from indicated resources to measured reserves—creating a dynamic growth pathway for investors.

At launch, Taurus Gold Token will be immediately tradable across multiple platforms, providing liquidity and accessibility from day one.

Utilization of Funds:

Investor proceeds are allocated in accordance with a governed agreement between Taurus Gold and the mine. The breakdown is as follows:

● 78% of funds will be deployed toward NI 43-101–compliant exploration drilling, executed by third-party geological contractors under the direction of the mining project and subject to milestone-based oversight.

● 20% is allocated to project management, platform development, and strategic execution, ensuring delivery of the investor platform, custody infrastructure, legal oversight, and reporting.

● 2% covers custodial, compliance, and smart contract–related infrastructure to support the post-raise issuance of tokens.

All funds are subject to contractual deployment controls. Taurus Gold maintains oversight to ensure capital is used strictly for the development and delivery of the tokenized gold program.

** In-depth details are available for download.

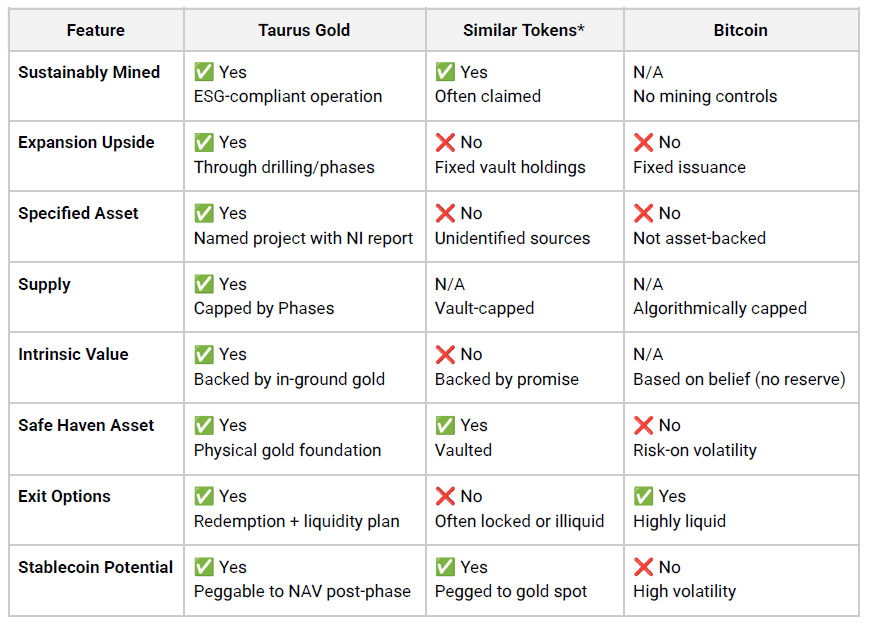

Taurus Gold vs Other Tokens

Not All Investments Are Created Equally

* “Similar Tokens” include legacy gold-backed instruments like PAXG, XAUT, and tokenized funds with vaulted allocations. Comparison based on typical market offerings as of 2025.

Most tokens claim to be gold-backed - few deliver visibility, pre-production upside, or phased redemption options. Taurus Gold is designed for investors who want asset-specifi c exposure with growth potential.

Buy Back

Secondary Sale

Further Expansion

Early Taurus Gold holders aren't just getting discounted gold - they're securing a stake in a growing, real-world asset with years of upside ahead

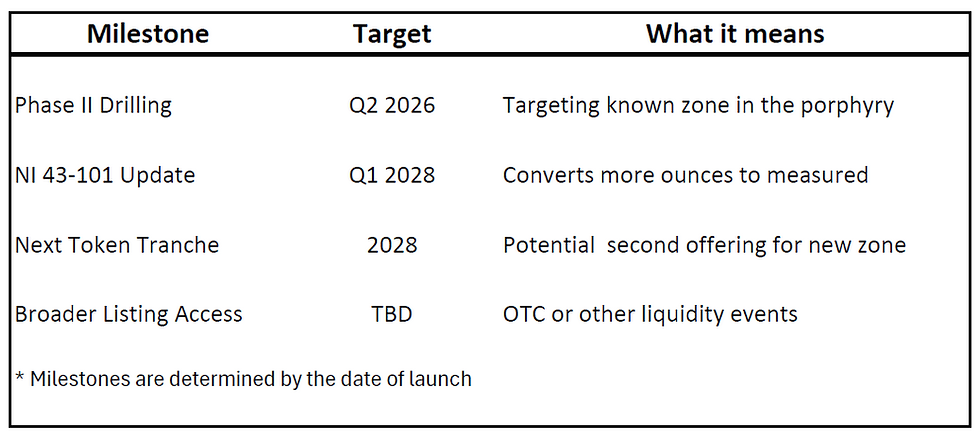

Looking Ahead :

The Expansion Strategy

What Taurus offers today is just the beginning . With our Phase I zone already independently verified and tokenized, we're now preparing to expand into additional zones with even greater potential. Each new drill, and each upgraded classification, compounds value for early investors.

This Isn't about one mine or one issuance. Taurus Gold is building the future of tokenized hard asset - and early participants are positioned at the foundation.

Stay informed

Not ready to invest yet? Stay informed about the latest news, events, and educational videos by following us on our social media channels or subscribing below:

Head Office

Nucleus Investments

900 N Federal Hwy,

Unit 306, Hallandale, FL 33009.

Tel : +18882523559

Email : info@taurusgoldtoken.com